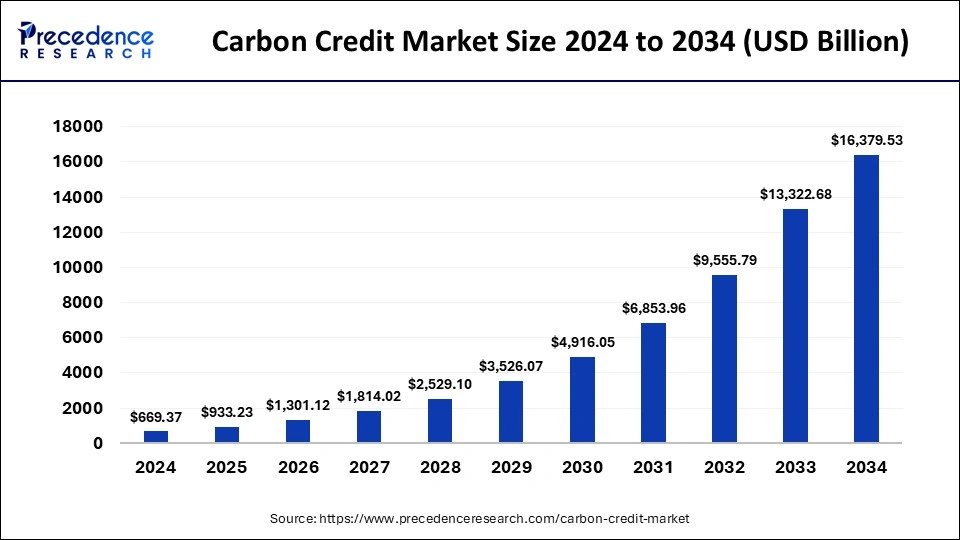

Carbon Credit Market Size Worth 16,379.53 Bn by 2034

According to Precedence Research, the global carbon credit market size is valued at USD 933.23 billion in 2025 and is expected to be worth USD 16,379.53 billion by 2034, growing at a robust CAGR of 37.68% from 2025 to 2034.

Ottawa, June 26, 2025 (GLOBE NEWSWIRE) -- In 2024, the carbon credit market size stood at USD 669.37 billion and is expected to rise from USD 933.23 billion in 2025 to USD 16,379.53 billion by 2034. The market is poised to grow at a double-digit CAGR of 37.68% from 2025 to 2034.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4396 - Book a Consultation

The carbon credit market is a system that allows companies to offset their greenhouse gas emissions by purchasing credits from entities that reduce or remove emissions. Each credit represents one metric ton of CO2 equivalent.

The market incentivizes sustainable practices and investment in green technologies. It operates through compliance markets, governed by regulations and voluntary markets, driven by corporate sustainability goals. As climate concerns grow, the carbon credit market is expanding globally, offering both environmental and financial benefits.

Also Read:Top Trends Driving the Environmental Monitoring Equipment Market

Carbon Credit Market Highlights:

- Europe dominated the carbon credit market in 2024, accounting for the largest revenue share.

- North America is projected to experience the fastest growth with a rising CAGR over the forecast period.

- The compliance segment led the market by type, contributing over 98% of the revenue in 2024.

- By project type, avoidance/reduction initiatives captured more than 67% of the total market share in 2024.

- The power sector emerged as the leading end-use segment, holding a 32% revenue share in 2024.

What is the Remarkable Potential for the Carbon Credit Market?

A carbon credit is a permit or certificate that represents the right to emit one metric ton of carbon di oxide (CO2) or an equivalent amount of another greenhouse gas. Carbon credits are used in efforts to reduce global emissions. They are earned by projects that actively reduce, remove, or avoid emissions such as reforestation, renewable energy, or energy efficiency initiatives. Companies or countries can buy these credits to offset their own emissions, helping them meet environmental regulations or voluntary climate goals.

Carbon credits encourage businesses to reduce their carbon footprint by putting a cost on emissions. Projects like reforestation or renewable energy generation can earn money by selling credits. Companies can choose to reduce their emissions directly or buy credits to offset them. The carbon credit helps to transfer funds from developed to developing countries for climate-positive projects.

Also Read: Why Commercial Greenhouses Are Key to Sustainable Agriculture

Major Trends in the Carbon Credit Market

-

Stronger Standards & Transparency

Initiatives like CDOP and SBTi Net-Zero 2.0 are enforcing data standardization, third-party verification, and rigorous quality controls marking a shift toward “professional, transparent, and accountable” voluntary markets.

-

Integration with Compliance Markets

The finalization of Article 6 rules at COP29 is driving cross-border compliance trading, with national ETS programs (e.g., China, Australia, Brazil, EU, India) becoming more interconnected.

-

Rise of Carbon Removal Credits

Demand is growing for CDR projects such as DAC, biochar, and afforestation with removal credits now capturing ~30% of retirements.

-

Digital & Tech-driven Innovation

Blockchain, AI, satellite-based MRV systems, and tokenization are enhancing traceability, reducing fraud, and enabling real-time verification.

-

Financial Instruments & Asset-class Development

Credits are being commoditized futures, swaps, options, ETFs are emerging attracting institutional investors and deepening market liquidity.

-

Portfolio Diversification & Vintage Optimization

Buyers are diversifying across project types (avoidance vs removal), geographies, and credit vintages (3-5 years “Goldilocks range”) to balance risk, quality, and price.

Access the Full Carbon Credit Market Intelligence Report@ https://www.precedenceresearch.com/carbon-credit-market

How Crucial is the Impact of Artificial Intelligence for the Overall Carbon Crediting?

Artificial Intelligence integration is revolutionizing the carbon credit market by improving accuracy, transparency, and scalability across the entire value chain. Through advanced data analytics, satellite imagery, and IoT integration, AI enables precise, real-time measurement and monitoring of carbon emissions and sequestration enhancing the credibility of carbon offset projects. It helps detect fraud, greenwashing, and double-counting by identifying anomalies and verifying claims, thereby boosting market transparency and trust.

- When paired with blockchain, AI can automate smart contracts, ensuring secure issuance, trading, and retirement of credits without manual intervention. AI also optimizes carbon credit pricing and trading strategies by analyzing supply-demand patterns and market dynamics.

Additionally, it accelerates the evaluation and certification of offset projects, making the process more efficient and cost-effective. Importantly, AI lowers entry barriers for small-scale sustainability initiatives by automating data reporting and validation, thus broadening participation in the carbon market. Overall, AI drives a smarter, more inclusive, and trustworthy carbon credit ecosystem, ultimately supporting global climate goals.

Which Potential Factors Impose Significant Concerns related to Market’s Growth?

-

Stricter Climate Regulations & Net-Zero Commitments

As more governments and corporations commit to net-zero carbon emissions, demand for verified carbon credits will surge. Companies unable to fully decarbonize internally will increasingly rely on carbon offsets to meet regulatory and ESG targets.

- For instance, in April 2025, The International Maritime Organization (IMO) has taken a significant step in the direction of creating a legally binding framework to lower greenhouse gas (GHG) emissions from ships worldwide, with the goal of achieving net-zero emissions by or near 2050. The first in the world to integrate obligatory emissions limitations and GHG price for a whole industry sector is the IMO Net-zero Framework.

- The Marine Environment Protection Committee approved the measures during its 83rd session (MEPC 83) from April 7–11, 2025. The measures include a global pricing mechanism for emissions and a new fuel standard for ships.

Also Read: Inside the High-End Greenhouse Market: Where Technology Meets Sustainability

-

Regulatory and Policy Frameworks

- Cap-and-trade systems: Governments set a cap on total emissions and allow companies to trade permits (e.g., EU ETS, California Cap-and-Trade).

- Carbon pricing laws: Policies that put a direct price on carbon emissions create demand for credits.

- International agreements: Agreements like the Paris Agreement encourage countries to reduce emissions, spurring credit generation and trading.

-

Voluntary carbon markets: Beyond regulations, companies and individuals voluntarily purchase credits to offset emissions, often for ESG goals.

-

Corporate Sustainability Goals (ESG Pressure)

- Net-zero commitments: Many corporations are pledging net-zero emissions and rely on carbon credits to offset residual emissions.

- Investor pressure: Asset managers and shareholders increasingly demand sustainability disclosures and climate action.

-

Reputation management: Companies use carbon credits as a tool to improve their brand image and avoid "greenwashing" criticism.

Limitations & Challenges in Carbon Credit Market:

Limited Transparency and Tracking

The key players operating in the market are facing issue due to limited transparency & tracking and high verification costs & complexity which has estimated to restrict the growth of the market. Inadequate verification and monitoring systems can obscure how credits are generated, traded, and retired. This lack of transparency discourages corporate participation and investor confidence. Certifying a carbon offset project involves complex, expensive, and time-consuming procedures, which can discourage smaller players, especially in developing countries, from entering the market.

Carbon Credit Market Report Coverage

| Report Attributes | Statistics | |

| CAGR 2025-2034 | 37.68% | |

| Market Size in 2024 | USD 669.37 Billion | |

| Market Size in 2025 | USD 933.23 Billion | |

| Market Size in 2030 | USD 4,916.05 Billion | |

| Market Size in 2032 | USD 9,555.79 Billion | |

| Market Size by 2034 | USD 16,379.53 Billion | |

| Base Year | 2024 | |

| Historic Years | 2020-2023 | |

| Forecast Years | 2025 to 2034 | |

| Growth Drivers | Rising awareness of GHG emissions, government mandates on carbon trading | |

| Key Opportunities | Expansion of voluntary carbon markets, technology integration in monitoring | |

| Major Restraints | Lack of universal standards, market transparency issues | |

| Segments Covered | Type, Project Type, End-use, and Regions | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

Set up a meeting at your convenience to get more insights instantly!

https://www.precedenceresearch.com/schedule-meeting

Carbon Credit Market Regional Analysis:

Which Region Held the Dominating Share in Carbon Credit Market?

Europe held the largest share of the carbon credit market in 2024, owing to strong regulatory framework and aggressive climate targets in the region. The European Union Emissions Trading System (EU/ETS) is the world’s largest and most mature carbon market. It sets a cap on total emissions and allows companies to buy or sell emission allowances, creating a price on carbon.

- The EU ETS covers power, manufacturing, aviation, and is expanding into new sectors (e.g., shipping). The EU has committed to become climate-neutral by 2050 and reduce emissions by at least 55% by 2030.

These goals drive high demand for carbon credits and push industries to either reduce emissions or purchase verified offsets. Europe maintains one of the highest carbon prices globally, making carbon credits economically significant and encouraging cleaner practices. European companies are global leaders in Environmental, Social, and Governance (ESG) commitments.

What to Expect from Germany in Carbon Credit Market?

As Europe’s largest economy and an industrial hub, Germany plays a leading role in the EU carbon market. Strong national carbon pricing alongside EU ETS participation in the Germany supports the market growth.

Major investments in renewable energy (Energiewende policy) in Germany as well as active support for international carbon offset projects in developing nations. Germany is both a significant emitter and offset buyer, and it sets standards for corporate climate disclosures across Europe.

Also Read: How Will Artificial Intelligence Transform the Renewable Energy Market from 2025 to 2034?

How is the Opportunistic Rise of the North America in Carbon Credit Market?

North America region is seen to grow at the fastest rate in the carbon credit market during the forecast period. In the absence of unified federal policy, regional programs like California Cap-and-Trade Program, The Western Climate Initiatives (WCI) and Quebec’s carbon market provide robust frameworks for emission trading. These markets link emissions caps to tradable carbon credits, encouraging participation from businesses and utilities.

Many North American corporations (e.g., Microsoft, Apple, Amazon) have set net-zero targets and are investing heavily in carbon offsets. Carbon credits are now integral to ESG strategies, CSR goals, and green branding for both tech giants and manufacturers. North America leads in AI, satellite monitoring, blockchain, and MRV (Monitoring, Reporting, and Verification) systems. These technologies ensure accurate emissions tracking, reducing fraud and boosting trust in carbon credits.

U.S. & Canada: Largest Contributors to Carbon Credit Market:

The U.S. operates multiple sub-national programs like California’s Cap-and-Trade and the Regional Greenhouse Gas Initiative (RGGI) in the Northeast. These programs allow regulated entities to trade carbon credits efficiently. Major U.S. companies (Microsoft, Apple, Google, Amazon) have aggressive net-zero goals and are driving demand for high-quality voluntary carbon credits.

Canada’s federal carbon pricing policy applies across all provinces and is set to rise annually. Emitters are incentivized to reduce emissions or purchase credits. Quebec’s carbon market is linked with California’s under the Western Climate Initiative, allowing for cross-border carbon credit trading.

Also Read: How Will IoT Revolutionize the Energy Market Between 2025 and 2034

How Big is the Success of the Asian Carbon Credit Market?

The Asia Pacific region is experiencing notable growth in the carbon credit market due to a combination of rapid industrialization, government climate initiatives, increasing private sector engagement, and abundant natural resources for offset projects.

- China launched the world’s largest carbon trading system, initially covering the power sector, and plans to expand it to other industries.

- South Korea operates a national Emissions Trading Scheme (K-ETS), one of the most advanced in Asia.

- India, Indonesia, and Vietnam are developing regulatory frameworks to implement carbon pricing and offset programs.

How Crucial is the Role of Latin America in Carbon Crediting?

Latin America is home to some of the world’s largest tropical forests, including the Amazon rainforest, which plays a major role in global carbon sequestration. Countries like Brazil, Peru, Colombia, and Ecuador offer vast opportunities for REDD+ (Reducing Emissions from Deforestation and Forest Degradation) projects.

How does Middle East and Africa Act into the Carbon Credit Market?

The Middle East and Africa are emerging leaders in the carbon credit market due to abundant renewable energy potential, vast natural ecosystems, and growing climate initiatives. Africa contributes significantly through nature-based solutions like reforestation, soil carbon, and mangrove restoration, supported by global climate finance.

The Middle East, particularly the UAE and Saudi Arabia, is investing in carbon capture, green hydrogen, and voluntary carbon markets through regional exchanges. Both regions benefit from increasing international collaboration, government-backed net-zero targets, and carbon offset projects that align with sustainable development goals, positioning them as key suppliers in the global carbon offset ecosystem.

Carbon Credit Market Segment Analysis

By Type Analysis

Why Does the Compliance Segment Lead the Global Carbon Credit Market?

The compliance segment dominated the carbon credit market with the largest share in 2024. Compliance markets are driven by legally binding emission reduction targets set by governments or international agreements (e.g., the EU ETS, California Cap-and-Trade). Companies are required by law to buy carbon credits if they exceed their emission caps.

Heavy-emitting sectors such as power, manufacturing aviation, and oil & gas are covered under compliance schemes, creating consistent and large-scale demand for carbon credits. Compliance markets are expanding globally and covering more sectors (e.g., shipping, construction), increasing credit demand and reinforcing their dominance over voluntary markets.

Also Read: How Is Generative AI Shaping the Future of the Energy Market from 2024 to 2034

What’s Driving the Rapid Growth of the Voluntary Carbon Credit Market?

The voluntary segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. Businesses worldwide are committing to net-zero emissions and integrating Environmental, Social, and Governance (ESG) targets. Voluntary carbon credits allow companies to offset unavoidable emissions as part of sustainability and brand positioning strategies. Voluntary markets are not bound by regulatory caps, offering flexibility in credit sourcing and project types.

This encourages innovation in nature-based solutions, blue carbon, carbon farming, and community-based projects. Buyers are increasingly seeking high-quality, verifiable credits, with additional environmental and social co-benefits (e.g., biodiversity, job creation), which are more readily available in voluntary markets. Platforms like Climate Impact X, Puro.Earth, and Verra have simplified access to voluntary credits, increasing transparency and scale through blockchain and digital MRV technologies.

By Project Type Analysis

Why Are Avoidance/Reduction Projects the Top Choice in the Carbon Credit Market?

The avoidance\reduction projects segment accounted for the largest eco-friendly food packaging market share in 2024. The avoidance/reduction project type dominates the carbon credit market due to its cost-effectiveness, scalability, and immediate impact on emissions.

Projects like renewable energy, energy efficiency, and methane capture prevent greenhouse gases from being released, offering fast, measurable results. These projects are widely accepted in both voluntary and compliance markets and are easier to implement than removal solutions. Their alignment with sustainable development goals and broad applicability across regions further strengthens their demand, making them the most preferred segment in carbon offset initiatives.

What Makes Removal Projects the Fastest-Growing Segment in Carbon Offsetting?

Removal/sequestration projects are the fastest-growing segment in the carbon credit market due to rising demand for permanent, high-integrity carbon offsets. As net-zero goals intensify, companies and governments seek solutions that actively remove CO₂ from the atmosphere.

Projects like afforestation, soil carbon sequestration, and direct air capture are gaining traction for their long-term climate impact. Technological advancements, improved monitoring tools, and premium pricing for removal credits further drive growth, making this segment increasingly attractive for meeting strict environmental and ESG standards.

By End-Use Analysis

Why Does the Power Sector Lead in Carbon Credit Demand and Generation?

The power end-use segment dominated the carbon credit market due to its high emission levels, strong regulatory inclusion, and large-scale project potential. As one of the largest sources of global greenhouse gas emissions, the power sector is heavily targeted by compliance markets like the EU ETS and China's national scheme.

Transitioning from fossil fuels to renewable energy generates substantial carbon credits, especially in developing regions. The sector’s scalability and strong corporate demand for clean energy offsets further support its leading position in the carbon credit ecosystem.

What’s Fueling the Rapid Growth of the Energy Sector in the Carbon Credit Market?

The energy end-use segment is the fastest-growing in the carbon credit market due to the global shift toward clean energy, supported by climate policies and green investments. Rising adoption of renewables, energy efficiency technologies, and smart grid systems enables scalable emission reductions. These projects offer measurable, high-integrity carbon offsets that meet the growing demand in both compliance and voluntary markets. Additionally, integration across industrial, commercial, and residential sectors broadens the scope for carbon credit generation, accelerating growth in this segment.

Related Topics You May Find Useful:

The global carbon credit trading platform market size was estimated at USD 131.40 million in 2024 and is predicted to increase from USD 153.70 million in 2025 to approximately USD 632.10 million by 2034, expanding at a CAGR of 17.01% from 2025 to 2034.

The global carbon capture and storage market size was accounted for USD 7.31 billion in 2024, and is expected to reach around USD 50.70 billion by 2034, expanding at a CAGR of 21.37% from 2025 to 2034.

The global carbon footprint management market size was valued at USD 11.19 billion in 2023 and is anticipated to reach around USD 27.08 billion by 2033, expanding at a CAGR of 9.24% from 2024 to 2033.

The global hydrogen energy storage market size was calculated at USD 17.59 billion in 2024 and is predicted to increase from USD 18.78 billion in 2025 to approximately USD 34.56 billion by 2034, expanding at a CAGR of 7.01% from 2025 to 2034.

The global oil and gas carbon capture and storage market size was estimated at USD 4.02 billion in 2024 and is predicted to increase from USD 4.61 billion in 2025 to approximately USD 15.71 billion by 2034, expanding at a CAGR of 14.60% from 2025 to 2034.

Carbon Credit Market Top Players

- 3Degrees Group, Inc.

- Carbon Care Asia Ltd.

- CarbonBetter

- ClearSky Climate Solutions

- EKI Energy Services Limited

- Finite Carbon

- NativeEnergy

- South Pole Group

- Torrent Power Limited

- WGL Holdings Inc

Recent Breakthroughs in Global Carbon Credit Market:

- In June, 2025, Builders Vision, an impact investor, is leading a USD$18 million investment round in Carbon Upcycling Technologies to extend its carbon collection and utilization technology. With a new deal with TITAN Group to evaluate prospects at two more locations and a significant project at the Ash Grove Mississauga Cement Plant, the investment bolsters the company's efforts to decarbonize the cement sector. The financing featured ongoing backing from prior backers who were highly confident in the commercial potential of carbon upcycling, including the Business Development Bank of Canada, Climate Investment, Amplify Capital, CRH Ventures, Oxy Low Carbon Ventures, and TITAN Group.

[Source: https://carbonherald.com/carbon-upcycling-secures-18m-investment-to-scale-low-carbon-cement-tech/]

- In June, 2025, Mitsubishi Electric Corporation, electronics company, declared that Archeda, Inc., a firm based in Japan that develops and offers carbon credit monitoring and analysis tools using satellite data, has received funding from its ME Innovation Fund. Businesses and other organizations can purchase and sell greenhouse gas reduction results (reduced or sequestered volumes) as emissions-allowance credits through the carbon credit system. Up until now, the fund has made eleven investments. Carbon offsetting has been a successful tactic as international efforts to become carbon neutral pick up steam.

[Source: https://mea.mitsubishielectric.com/en/pr/global/2025/0610/?category=&year]

- In May 2025, Senior bank officials announced that the African Development Bank will open a carbon markets support facility for the continent in order to provide funding for an area that is increasingly affected by storms and droughts connected to climate change. Africa's leading multilateral development lender, which also announced on Thursday that it has elected former Mauritius Finance Minister Sidi Ould Tah as its president, stated that the Africa Carbon Support Facility, which is now in the design phase, will consist of two parts.

The Carbon Credit Market report is categorized into the following segments and subsegments:

By Type

- Compliance

- Voluntary

By Project Type

- Avoidance / Reduction Projects

- Removal / Sequestration Projects

- Nature-based

- Technology-based

By End-use

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Industrial

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report https://www.precedenceresearch.com/checkout/4396

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor

Get Recent News:

https://www.precedenceresearch.com/news

For Latest Update Follow Us:

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.